Are you pursuing a unique passion or embarking on an unconventional business venture? If so, you may find yourself in need of specialty financing solutions to help bring your dreams to life. Traditional loans and funding options don’t always fit the mold for niche pursuits. But it’s not the end of the day because there are lots of alternatives you can choose. So, keep on reading as we’ll take a closer look at some alternative avenues that cater specifically to those with distinct ambitions. Whether you’re starting a boat rental or adding more aircraft units to your fleet, there are options available to support your one-of-a-kind endeavors.

Niche Loans

Grants and Sponsorships

Moreover, it’s also a good idea to look for grant opportunities or a sponsor. These funding options are specifically designed to support individuals or organizations with innovative ideas or projects. Grants are typically offered by government agencies, foundations, or non-profit organizations. They provide financial assistance without the need for repayment. This makes grants an attractive option for those looking to fund their niche ventures. On the other hand, sponsorships involve partnering with companies or individuals who are willing to invest in your pursuit in exchange for promotion or involvement in the project. Sponsors can offer monetary aid as well as resources like mentorship or access to networks.

Venture Capital for Niche Ventures

While traditional venture capital firms may focus on more mainstream industries, there are specialized investors who specifically seek out niche ventures. These niche-focused venture capitalists understand the potential of unconventional business models and are willing to take calculated risks. They have deep knowledge and experience in specific sectors, allowing them to identify promising opportunities that others might overlook. While securing venture capital for a niche venture can be challenging due to its inherent riskiness, demonstrating a strong understanding of your market, clear growth strategies, and a solid execution plan will increase your chances of success.

Specialized Investors and Partnerships

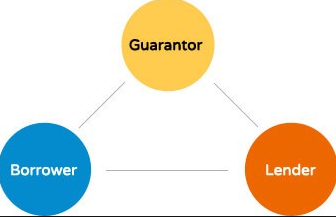

Partnering with specialized investors not only provides the necessary capital for your venture but also brings valuable industry insights and connections. These investors often have extensive networks within the specific field you’re operating in, which can open doors to new opportunities and collaborations. In addition to financial support, partnerships with established companies or organizations in your niche can provide access to additional resources such as equipment, facilities, or marketing expertise. Collaborating with like-minded entities allows you to leverage each other’s strengths while sharing risks associated with pursuing unconventional endeavors.

When it comes to pursuing unique and specialized ventures, traditional financing options may not always be the best fit. That’s where specialty financing solutions come into play. Whether you’re looking for niche loans, specialized investors and partnerships, grants and sponsorships, or venture capital for your niche pursuit, there are options available to help bring your vision to life.…