Are you urgently needing cash but skeptical about taking out a title loan? We get it. With so many providers flooding the market, finding a reliable and reputable one can feel like searching for a needle in a haystack. But fear not. In this step-by-step guide, we will walk you through choosing the perfect title loan provider that meets your financial needs and ensures peace of mind. So buckle up and get ready to navigate this tricky terrain with confidence.

Research Extensively

Before committing to a title loan provider, invest time in comprehensive research. Use online resources to compare different lenders, terms, interest rates, and customer reviews. Consider factors such as the lender’s reputation, years of operation, and compliance with state regulations. A reputable lender will have a transparent online presence, providing clear information about their services and terms.

Check State Regulations

Title loan regulations vary by state, which means lenders must adhere to specific guidelines depending on where they operate. Ensure that the lender you are considering is fully licensed and regulated in your state. This ensures compliance with local laws and offers an added layer of protection for borrowers. Online Title Loans can help you find a lender that meets all the requirements in your area.

Evaluate Interest Rates and Fees

Interest rates and fees associated with title loans can significantly impact the overall cost of borrowing. Thoroughly review the lender’s interest rates and any additional fees they charge.

Compare these figures with other lenders to understand what constitutes a fair and competitive rate. Remember that reputable lenders will be transparent about their interest rates and fees and will provide this information upfront.

Read Customer Reviews

Customer feedback can provide valuable insights into the experiences of previous borrowers with a specific title loan provider. Look for reviews on reputable platforms to understand the lender’s customer service, transparency, and satisfaction. Be cautious if you notice many negative reviews or consistent complaints about a lender’s practices.

Inquire About Repayment Flexibility

A reputable title loan provider should offer flexible repayment options to accommodate your financial circumstances. Before finalizing any agreement, inquire about repayment terms, early payment options, and any potential penalties for prepayment. A lender that is willing to work with you to structure a repayment plan that aligns with your income cycle is a positive sign.

Check Terms and Conditions

Transparency is vital when it comes to financial transactions. Ensure that the title loan provider clearly outlines all terms and conditions associated with the loan. Carefully review the loan agreement, paying attention to details such as the loan amount, interest rate, repayment schedule, and any potential consequences of default. If a lender hesitates to provide clear, straightforward information, it’s a red flag.

Customer Service and Communication

Effective communication and responsive customer service indicate a lender‘s professionalism and commitment to their clients. Reach out to the lender’s customer service department with any questions you may have. Assess their responsiveness, willingness to address your concerns, and ability to provide accurate information.

In the realm of title loans, selecting the right provider can make a significant difference in your borrowing experience. Thorough research, careful evaluation of terms and conditions, and attention to customer reviews are vital steps in identifying the best title loan provider for your needs. Remember that responsible borrowing is paramount, and only work with lenders who prioritize your financial well-being throughout the loan process.…

If you find yourself struggling to pay off your existing debts, it may not be the best time to apply for a loan. Taking on additional debt when you’re already having difficulty managing your current financial obligations can create a vicious cycle that’s hard to break free from. It’s going to be chaotic if you pay off your current debt using a new loan.

If you find yourself struggling to pay off your existing debts, it may not be the best time to apply for a loan. Taking on additional debt when you’re already having difficulty managing your current financial obligations can create a vicious cycle that’s hard to break free from. It’s going to be chaotic if you pay off your current debt using a new loan.

In this era, crowdfunding is an increasingly popular way for people to gain financial assistance for medical expenses. There are several crowdfunding platforms available, and each one has a slightly different process for setting up campaigns, collecting donations, and dispersing funds. With the help of social media networks, you can quickly spread awareness of your cause and attract generous donors from around the globe.

In this era, crowdfunding is an increasingly popular way for people to gain financial assistance for medical expenses. There are several crowdfunding platforms available, and each one has a slightly different process for setting up campaigns, collecting donations, and dispersing funds. With the help of social media networks, you can quickly spread awareness of your cause and attract generous donors from around the globe.

In a failing economy, it can be challenging to get ahead. Many of us find ourselves barely scraping by, even when we’re employed. So, what can a loan do for us?

In a failing economy, it can be challenging to get ahead. Many of us find ourselves barely scraping by, even when we’re employed. So, what can a loan do for us? So, what’s the verdict? Should we take out

So, what’s the verdict? Should we take out

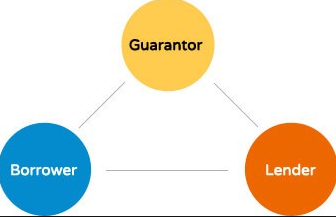

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments.

These loans are similar to unsecured loans because the borrower does not need to own a car, a piece of land or home because no collateral is needed. The borrower should get another person who will act as a guarantor for them. This happens because the borrower has a poor credit history or no credit history at all. The guarantor signs to pay the loan in case the borrower does not meet the agreed monthly repayments. This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.

This depends on the lender, but normally, after the receipt of all the documents required, the lender starts the processing and releases the funds. This should take no more than seven working days. After the decision is made to release the loan, the lender enters all the documents required and sends money to the borrower in the form of a cheque. As mentioned earlier, the whole process should not take more than seven business days.